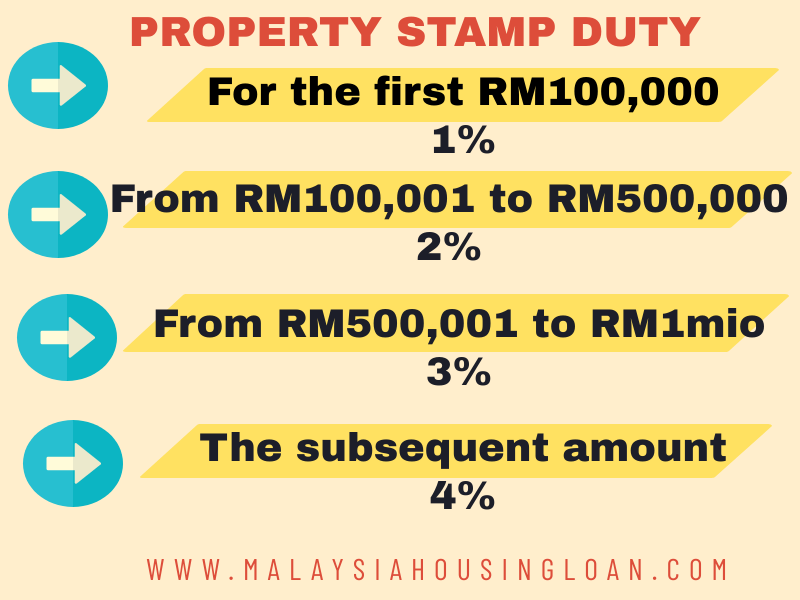

Budget 2022 Stamp Duty Exemption For First-Time Buyers. The stamp duty rate will depend on factors such as the value of the property if it is your primary residence and your residency status.

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

An instrument relating to the sale and purchase of retail debenture and retail sukuk as approved by the Securities Commission under the Capital Markets and Services Act 2007 Act 671 are exempted from stamp duty.

. Additionally under Budget 2022 Finance Minister Tengku Zafrul announced that the government will no longer impose Real Property Gains Tax or RPGT for property disposals by individuals comprising Malaysian citizens permanent residents and. It was proposed under the National Economic Recovery Plan 2020 that a stamp duty exemption will be given for MA of SMEs approved by the Ministry of Entrepreneur. This exemption order applies to a retail investor who is an individual for instruments executed on or after 1 Oct 2012 and not.

How to do e-Filing for Individual Income Tax Return. The stamp duty rate ranges from 2 to 12 of the purchase price depending upon the value of the property bought the purchase date and whether you are a multiple home owner. The first RM2400 of your annual rental income is entitled for stamp duty exemption.

Then theres another revision to the RPGT under Budget 2020 as well as the Exemption Order for 2020. Stamp duty exemption on instrument of agreement for a loan or financing in relation to a Micro Financing. HRCC is medium provided by the IRBM to handle all questions regarding payment of taxes and stoppage order imposed on taxpayers.

Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The stamp duties and real property gains tax are exempted for BioNexus Company that enters into mergers or acquisitions with other biotechnology companies. Meanwhile Victoria offers a full exemption to first-home buyers who purchase a new or established home worth up to 600000 as long as they live in the property for at least 12 months and stamp duty discounts to those who buy property valued between 600000 and.

Exemption is given on import duty for raw materials and components that are imported by the companies. Under Budget 2021 first-time house buyers for residential properties in both the primary and secondary markets valued under RM500000 will receive the full stamp duty exemption on the memorandum of. Stamp duty exemption on loanfinancing agreements executed from 1 January 2022 to 31 December 2026 between MSMEs and investors for funds raised on a peer-to-peer P2P platform registered and recognised by the Securities Commission Malaysia.

3 Things To Look Out For In The. Information on Income Tax Appeal. Stamp Duty Exemption for First Time House Buyers from 1 January 2021 to 31 December 2025.

Review Tax Rate Tax Exemption Tax Relief and. Therefore when calculating the stamp duty fee you need to deduct RM2400 from the annual rental amount to determine the taxable rental. The main tax incentives available in Malaysia include pioneer status an exemption based on statutory income and investment tax allowance based on capital expenditure.

What is stamp duty. What are the latest stamp duty exemptions in Malaysia. Calculate the stamp duty you may have to pay on your property using our tool.

SPA Stamp Duty Malaysia And Legal Fees For Property Purchase. During the Budget 2021 tabling Finance Minister Tengku Datuk Seri Zafrul Tengku Abdul Aziz stated that first-time buyers will be given stamp duty exemptions on the memorandum of transfer documents MOT and loan agreements. The remittance is applicable for all contract notes from Jan 1 2022 to Dec 31 2026 for all stocks listed on Bursa Malaysia it said.

Stamp duty is a tax on a property transaction that is charged by each state and territory the amounts can and do vary. Information on Stamp Duty. The call centre provides friendly service by Recovery Tax Consultant TRC regarding the method of payment of personal income tax company monthly tax deduction PCB as well as payments for stoppage order.

Stamp duty is a tax on big transactions such as property transfers. Stamp duty exemption on the instruments of transfer and loan agreement for the purchase of residential homes priced between RM300000 to RM25 million subject to at least 10 discount provided by the developer. Individual who are not citizens of Malaysia.

Approved and are operated by non-residents of Malaysia by using a website in. The following are the legal fees rate in. Stamp Duty Land Tax SDLT is a tax paid by the buyer of a UK residential property when the purchase price exceeds 125000.

Type of Income Tax Return Form ITRF for Individual. The exemption on the instrument of transfer is limited to the first RM1 million of the property price while full stamp duty exemption is given on loan. In the Budget 2022 announcement the government had proposed to raise stamp duty on share contract notes from 01 per cent to 015 per cent which is equivalent to RM150 for every RM1000.

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption Malaysia 2019 Malaysia Housing Loan

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Budget 2021 Stamp Duty Exemption 2021 2025 And Other Benefits Malaysia Housing Loan

2020 Stamp Duty Exemptions News Articles By Hhq Law Firm In Kl Malaysia

Stamp Duty Waivers Will Boost Housing Market Says Knight Frank Malaysia The Edge Markets

Stamp Duty Calculation Malaysia 2022 And Stamp Duty Malaysia Exemption Malaysia Housing Loan

Covid 19 Real Estate Legal Updates The Malaysian Government Introduces Special Measures To Revitalise Real Estate Market Azmi Associates

Stamp Duty Exemption How To Save Money Property Investments Malaysia

Updates On Stamp Duty Malaysia For Year 2022 Malaysia Housing Loan

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Stamp Duty Exemption For House Buyers Infographics Propertyguru Com My

Exemption For Stamp Duty 2020 Malaysia Housing Loan

The 2019 Stamp Duty Exemption Property Insight Malaysia Facebook

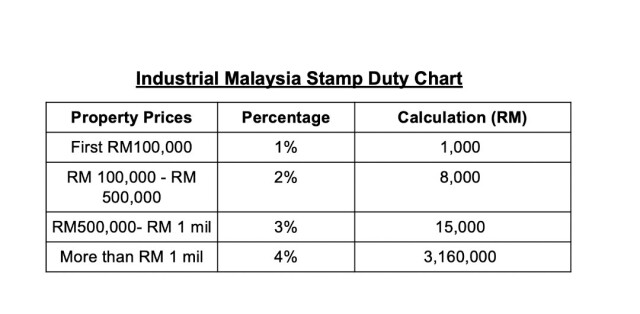

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

What Is Memorandum Of Transfer How Does It Work In Malaysia Blog

大马房地产爆料站 Property Insight Malaysia The 2019 Stamp Duty Exemption For First Time Home Buyers In An Effort To Reduce The Cost Of Ownership Of First Home For Malaysian Citizens The Stamp

Stamp Duty Exemption When Buying Subsale Property For First Time Home Buyer Kopiandproperty Com